In the realm of fraud prevention, the Fraudulent Signal Detection and Compliance Division plays a crucial role. By leveraging advanced technologies and analytical methods, you can identify suspicious activities effectively. Understanding the interplay between machine learning algorithms and compliance measures is vital for safeguarding your organization. However, the implications of these strategies on operational integrity raise questions worth exploring further. What specific technologies are driving these changes, and how do they enhance security in financial transactions?

Overview of the Fraudulent Signal Detection and Compliance Division

The Fraudulent Signal Detection and Compliance Division plays a crucial role in safeguarding organizational integrity.

You’ll find that its primary focus is on fraud prevention and risk assessment. By identifying potential threats and analyzing patterns, this division empowers your organization to mitigate risks effectively.

Their proactive measures ensure that you maintain a transparent environment, fostering trust and autonomy within your operations.

Technologies Utilized in Fraud Detection

Advanced technologies form the backbone of effective fraud detection systems.

You’ll find machine learning algorithms analyzing vast data sets to identify patterns indicative of fraudulent behavior. Predictive analytics enhances these systems by forecasting potential threats based on historical data.

Together, these technologies empower organizations to proactively combat fraud, ensuring a more secure environment while maintaining the freedom of user interactions.

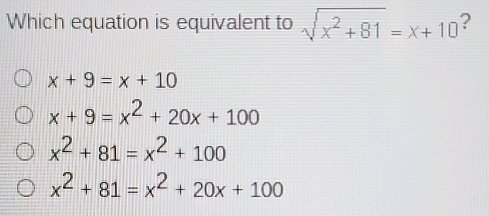

Analytical Methods for Identifying Suspicious Activities

Numerous analytical methods are employed to spot suspicious activities, each designed to enhance detection efficacy.

You’ll find that pattern recognition algorithms efficiently identify trends, while anomaly detection techniques highlight deviations from typical behavior.

Combining these methods allows you to uncover hidden threats and improve overall security.

The Importance of Compliance in Financial Transactions

While navigating the complexities of financial transactions, compliance plays a crucial role in safeguarding against fraud and ensuring regulatory adherence.

By understanding compliance regulations, you enhance financial integrity, fostering trust with stakeholders. Non-compliance can lead to severe penalties, eroding your reputation and financial stability.

Prioritizing compliance isn’t just about following rules; it’s about protecting your freedom to operate effectively in the financial landscape.

Conclusion

In the ever-shifting landscape of financial transactions, the Fraudulent Signal Detection and Compliance Division stands as a vigilant lighthouse, guiding organizations through the fog of potential fraud. By harnessing cutting-edge technologies and sharp analytical methods, you can navigate this turbulent sea with confidence. Prioritizing compliance isn’t just a safeguard; it’s the bedrock of your organization’s integrity. Embrace these tools, and you’ll cultivate an environment where trust flourishes, illuminating your path to financial stability.