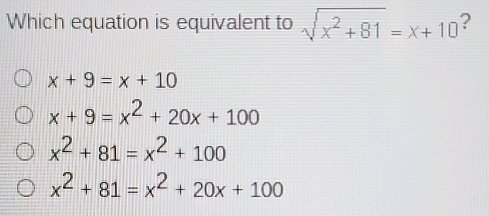

In this market data review, you’ll analyze identifiers 120964453, 938600075, 72620448, 9514254239, 685191035, and 2107141981 to uncover vital insights about asset performance and emerging trends. You’ll notice shifts towards sustainable investments and technology adoption, which could significantly impact your portfolio. As you consider volatility and market correlations, you’ll find that understanding these dynamics is essential for strategic decision-making. What factors will ultimately shape your investment approach?

Overview of Key Market Data Identifiers

In the world of finance, understanding key market data identifiers is crucial for effective analysis and decision-making.

These identifiers help you track market trends, ensuring you make informed choices. By leveraging data identifiers, you can evaluate the performance of assets and gauge overall market sentiment.

Staying attuned to these elements empowers you to navigate the financial landscape with confidence and clarity.

Performance Analysis of Individual Assets

While analyzing the performance of individual assets, it’s essential to consider various metrics that provide insights into their value and potential for growth.

Focus on asset volatility and price movements to gauge risk assessment accurately.

Additionally, examine market correlations, as they can impact your investment strategy.

Trends and Insights Across the Market

As you explore the current market landscape, several trends and insights stand out, shaping investment strategies and influencing asset performance.

Key market trends indicate a shift towards sustainable investments, while technology adoption accelerates in various sectors.

These investment insights reveal opportunities for diversification and growth, encouraging you to adapt your portfolio in response to evolving market dynamics and emerging consumer preferences.

Implications for Investors and Portfolio Management

Recognizing the trends towards sustainable investments and technological advancements is vital for shaping your investment strategy.

Focus on risk assessment to enhance your asset allocation and portfolio diversification.

As market volatility increases, adapting your investment strategies becomes crucial.

Regularly evaluate performance metrics to ensure your portfolio aligns with your financial goals, allowing you the freedom to navigate changing market conditions effectively.

Conclusion

In conclusion, navigating the landscape of assets like 120964453 and 938600075 is like steering a ship through shifting tides; understanding market trends is essential for successful investing. By continually assessing performance metrics and embracing sustainable investments, you can align your portfolio with emerging opportunities. Stay alert to volatility and correlations, as these insights empower you to make informed decisions and diversify your investments effectively. The right strategies now can lead to robust growth in the future.